Award-winning PDF software

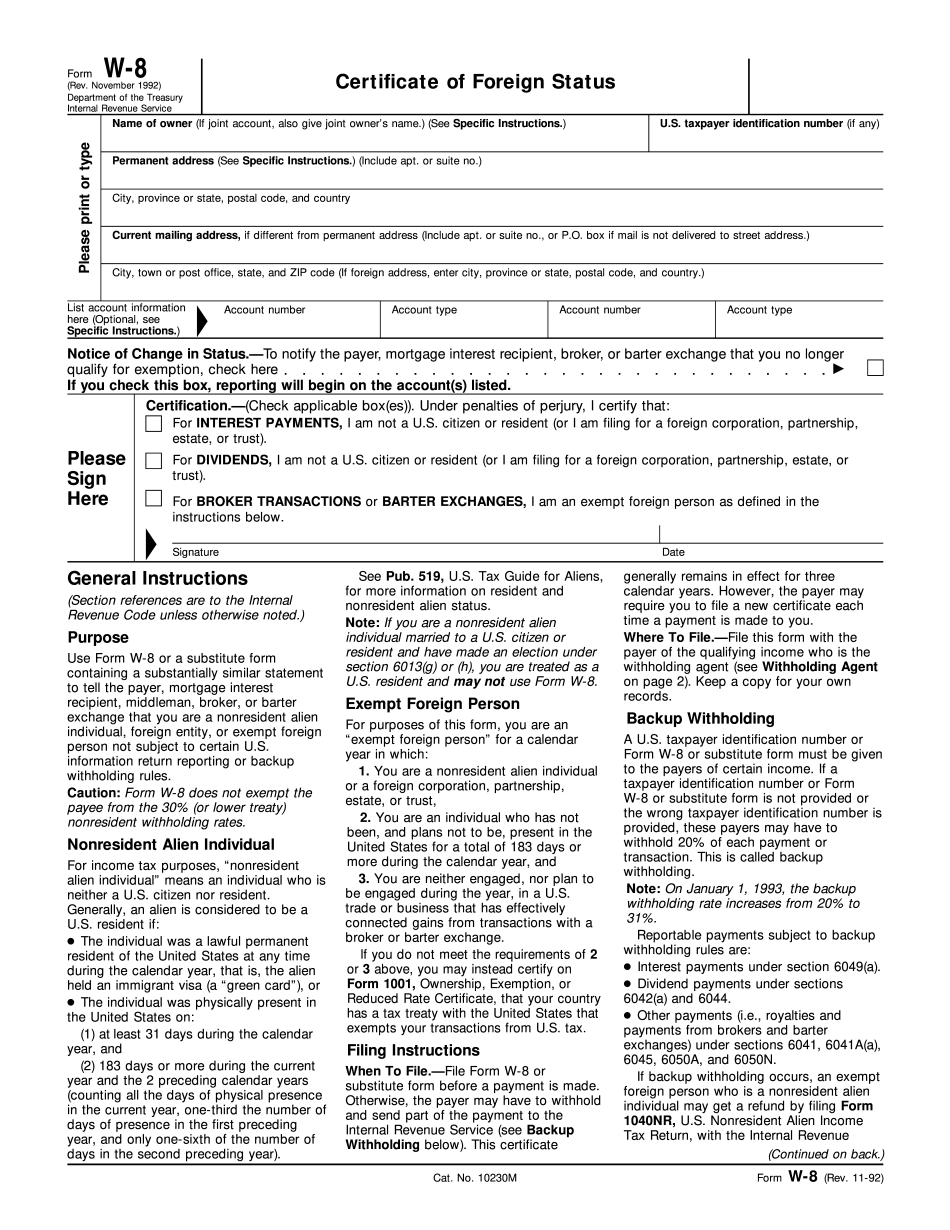

Printable Form W-8 Long Beach California: What You Should Know

If you are a new owner of housing, this form is also needed for the following entities: A. The owner of rental housing who receives 1,000 or more per calendar year. The amount you receive must be included on your U.S. federal income tax return, but you have to fill out Form W-8BEN if you want to file Form 1040. (You don't have to do this if you are a contract tenant.) B. The owner and contractor of housing, including projects funded partially or wholly through a combination of City of Long Beach funds and private development. (See attached Form W-5.) C. A cooperative housing corporation whose owner-contractor(s) are engaged in the construction of new housing units only or in the design, alteration, rehabilitation or construction of units in common (whether constructed on land or in a building) to persons who meet the affordability standards established by the Board. D. The owner of the condominium unit, in addition to the provisions in subparagraphs (A) and (B) above, who receives at least a minimum of 1,600 per calendar year. (See attached W-8BEN form.) E. The owner and contractor of housing, including projects funded partially or wholly through city funds; and a contract tenant who receives at least a minimum of 1,400 per calendar year. (See attached W-8BEN form.) F. The owner of the condominium unit, in addition to the provisions in subparagraphs (A) and (B) above, who receives at least 800 per calendar year to pay for the cost of maintaining the housing. (See attached W-8BEN form.) 2. If you are a corporation, the name of the corporation or joint stock company must be included in Boxes 1 and 7 of form W-8BEN to show that the corporation or its officers or their family members are eligible to file Form 1040, U.S. tax return. See the instructions. What to Include When You File Form W-8BEN When you file Form W-8BEN, you have to list all the following: F.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form W-8 Long Beach California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form W-8 Long Beach California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form W-8 Long Beach California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form W-8 Long Beach California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.