Award-winning PDF software

Form W-8 Wilmington North Carolina: What You Should Know

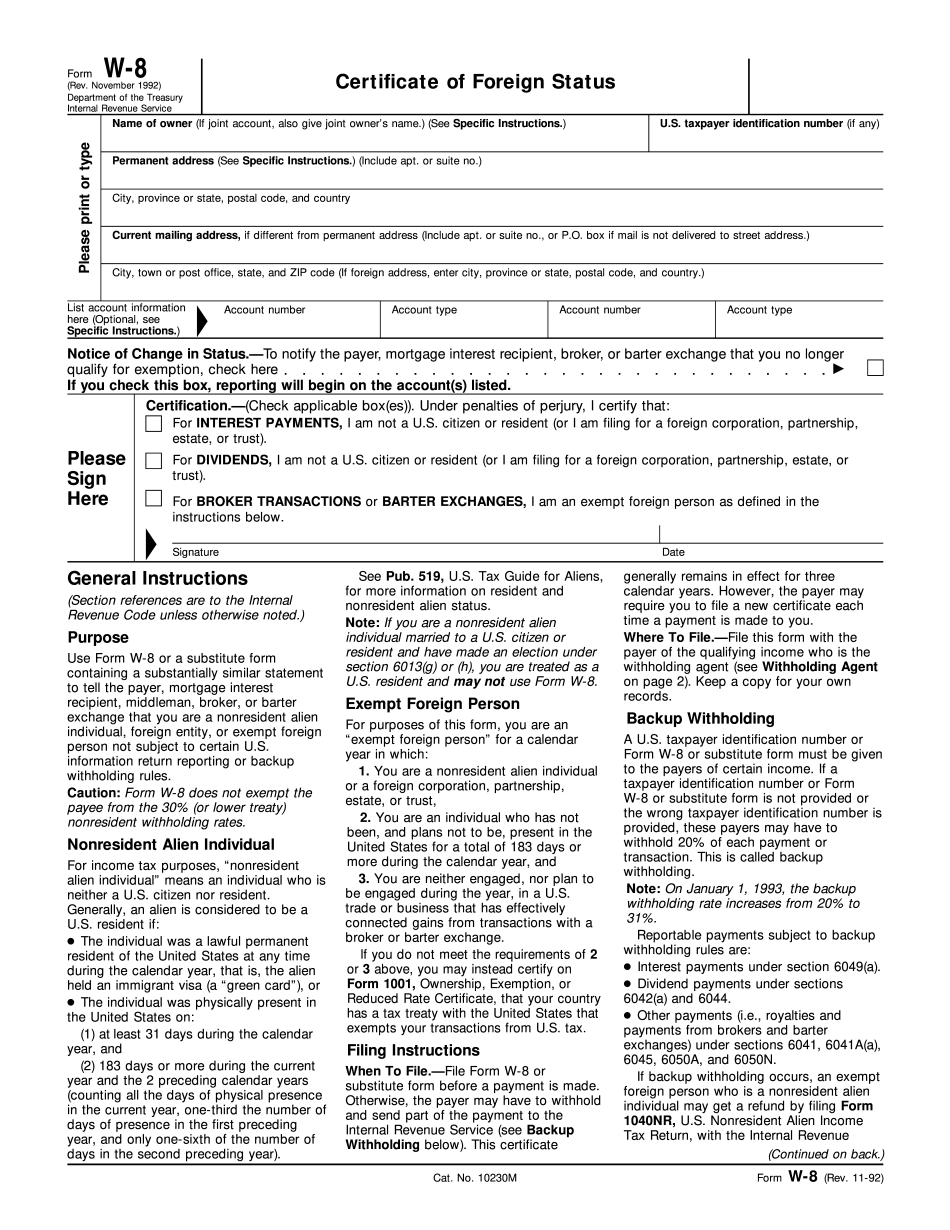

NC. We welcome your interest and hope you will complete this application, and we invite you back for further opportunities. If your business or corporation is in need of a new, highly efficient, and efficient bid software program, you may contact the City of Wilmington, NC Revenue Department Sales. You may also apply the program to your next public works or street department project. For assistance, visit our contact page. In the process of determining employment eligibility for unemployment insurance (UI), we require additional information and may make further inquiries as described below. You must provide this information to us by the date indicated below, or you could be ineligible to receive benefits from UI. If you do not provide this information, you will be required to report your income in a manner that may cause your unemployment benefit payments to be denied. You should be aware that, in most situations, you will not receive benefits if you do not provide all the information required. You should not submit an application unless you plan to file a U.S. income tax return for the current tax year. I am requesting an Unemployment Disability Insurance (UI) claim. Does this need to be completed on a different form? No. This application is not required to be submitted on a claim form. However, it is strongly recommended that you submit a U.S. Treasury form 1040 and an Employer's Form W-2. It is very important to ensure that you have filed a legitimate tax return for the current year in order to be approved for an unemployment benefit payment. In the past, the Unemployment Trust Fund (UTCF) has erroneously denied benefits to applicants who were not required to have reported their Social Security numbers in a U.S. Treasury Form 1040. The UTCF is designed to pay benefits for eligible unemployed individuals, not applicants who were not required to report their social security numbers. If you or any of your family applies for UI assistance, it is important to ensure that you have filed a current tax return for the past year. If you have not, you must provide copies of both of the following documents. Tax Return for Tax Year 2025 (PDF): United States Federal Tax Return or U.S. Federal Income Tax Return (if your taxpayer identification number is 1040-T or 1040NR). Unemployment Disability Insurance (UI) Claim: United States Federal Tax Return or U.S. Federal Income Tax Return (if your taxpayer identification number is 1040-T or 1040NR).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-8 Wilmington North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-8 Wilmington North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-8 Wilmington North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-8 Wilmington North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.