Award-winning PDF software

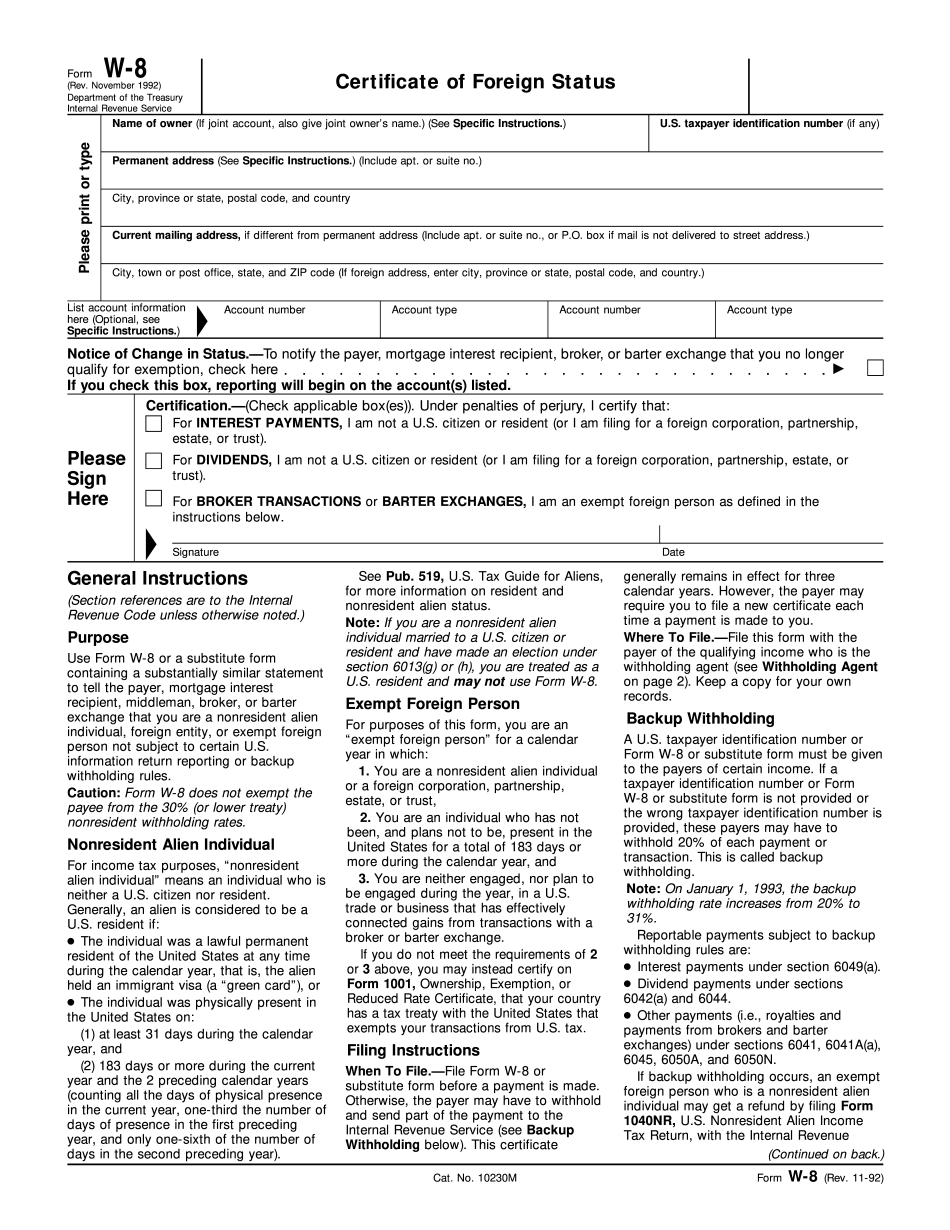

Form W-8 for Eugene Oregon: What You Should Know

Business Accounts If you are a commercial business, you must have a valid W-9 with us as well because you are reporting business income. Business Accounts can be done online. We only send electronic invoices for business accounts unless a letter or form is received within 7 days of payment. If you need an actual copy of the invoice please see the instructions on the form. We need a business account, so the IRS can process the accounts. • Please go to the website of your accountant. I need to know which account goes to which office. • I am an owner and need to know which office goes to which owner/agent. • I am an agent and want to have one set to pay all accounts for me and another set to pay those for his agents. Business Accountants Accounting software companies can be costly and the IRS can charge your company an administrative fee of 100 – 200 per hour. If you are going to use a software company, find out if it charges an administrative fee. If it does, you should be able to easily file your taxes using them. The company will tell you that the fee is for filing. It is not for processing your payments. The company will not charge you a fee for completing the business account. However, they do require that you fill out a 1099 form with them every 10 years. If you don't pay their bill by the due date they will close the account. This isn't legal because you have a right to cancel the account. They charge the same fee for business accounts that they charge for personal or partnership accounts. If you have a business account, this company should have a tax account for you since it is doing your income tax paperwork for you. You need to call your accountant and request the IRS account as soon as possible. There might be an administrative fee involved in ordering the account and filling it out. I usually have the money in the account the first weekend in October, so I can have it by the time the forms are sent out. If your company doesn't have an accountant for you, you may need to find a CPA to help you. If the accounts you are paying for are not required to be paid by October 15, you should get the forms for them ASAP.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-8 for Eugene Oregon, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-8 for Eugene Oregon?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-8 for Eugene Oregon aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-8 for Eugene Oregon from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.