Award-winning PDF software

Form W-8 Corona California: What You Should Know

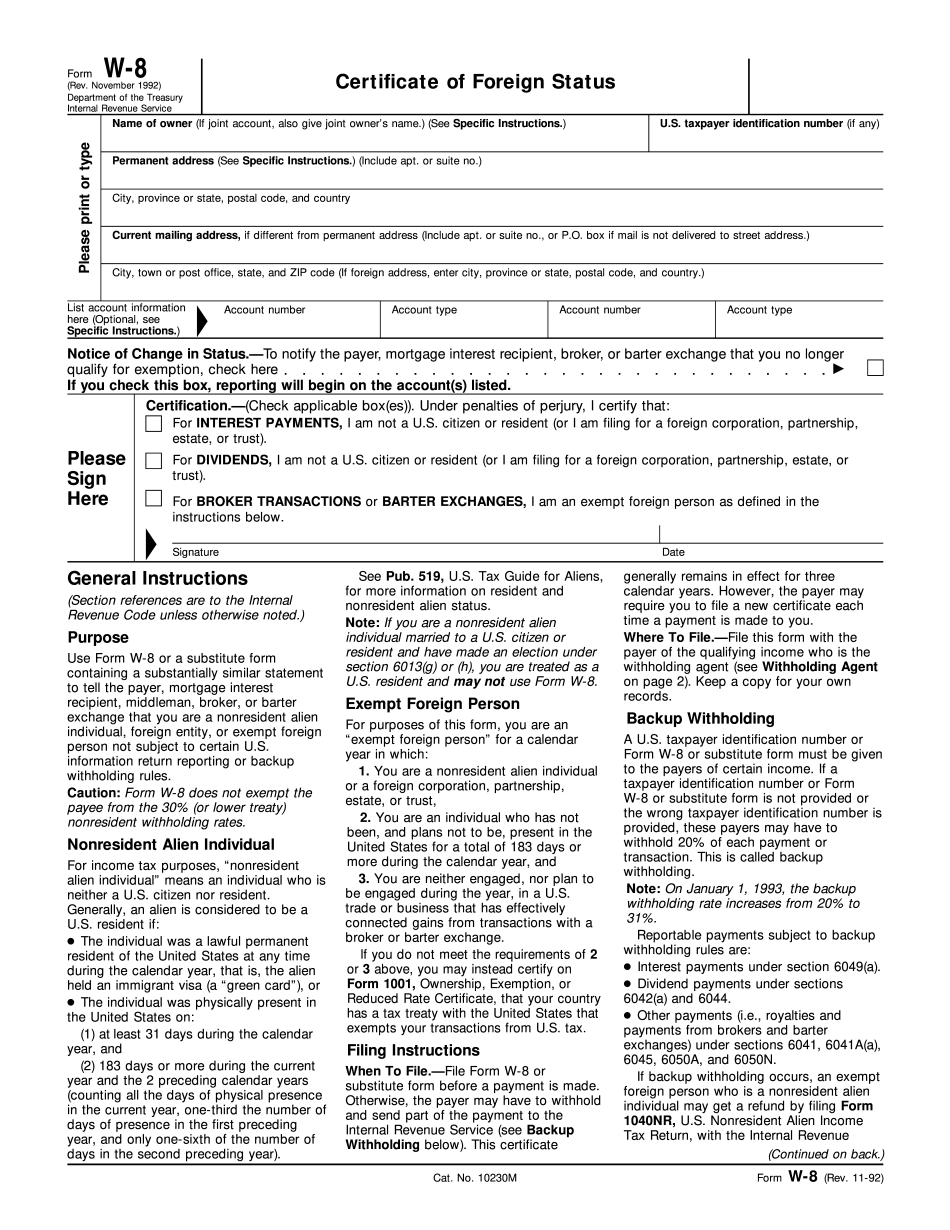

Have the landlord / property management agent / company obtain a copy of the W-8BEN form from the Internal Revenue Service (IRS). 10. Submit a signed copy of your original income tax return to certify that you met IRS Form 8889, “Election to Report Notices under Section 64.110(a) of the Internal Revenue Code.” The COVID-19 ETS program helps landlords or property management companies comply with Section 8 of the Housing and Community Development Act (HONDA) and the California Fair Housing Act (CA FHA) by implementing more effective housing security plans and procedures, and promoting the safe, responsible, and quality housing condition in residential rental housing. Submit a W-9 form completed by the landlord / property management agent or company. 7. Submit evidence of the current rental balance and / or utility balance. 8 9. Have the landlord / property management agent / company obtain a copy of the COVID-19 form and complete Form 594, “Occupancy Requirements For Housing Development Projects,” from the City of Los Angeles Department of Buildings. 10. Submit a signed copy of your original income tax return to certify that you met IRS E-FICA income tax reporting requirements. COVID-19 Temporary Standards A: The Department of Housing and Community Development (DID), pursuant to its authority under Section 3(a) of the City of Los Angeles Rent Law, and the City of Los Angeles, are issuing a temporary emergency rent increase of 5.00 per unit due as determined by the Secretary of Housing and Community Development (DID) based on HUD Guidelines (UG) F.H.R. No. 2132 (Effective as of January 18, 2016, pending final approval of HAD and City Council) (DHC), Effective November 1, 2025 (effective January 1, 2013) (HAD). G.R. No. 4 (Amended as of January 26, 2014, pending final approval of the HAD Board of Directors) (DHC). W.R. No. 815 (Amended as of February 16, 2013, pending final approval of the HAD Board of Directors) (HAD). F.F. No. 9 (Effective as of December 31, 2013) (DHC), Effective March 1, 2025 (effective July 1, 2015) (HAD). F.C.C.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-8 Corona California, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-8 Corona California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-8 Corona California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-8 Corona California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.