Award-winning PDF software

Form W-8 Anchorage Alaska: What You Should Know

Any portion of the Tax collected by the hotel must be forwarded to the Department of Revenue by the hotel operator to cover the cost of the tax. The 10% tax must be paid for each rental period. The 10% tax is collected once in each quarter. The 10% tax may apply only to rooms less than 10 percent of the hotel's total room count. Hotel operators are responsible for any tax collection. If you are considering a Room Tax for Anchorage lodging services, look in the Anchorage Municipal Codes and Chapter 12.20 of the City Code. Chapter 12.20 states that: “The tax shall apply to residential rooms in hotels (1) which are part of a short-term, residential or office operation for not longer than 3 months in any calendar year, and (i) at rates not in excess of 50 per night. (ii) The tax shall not apply to rooms for short-term, residential or office operation to be used exclusively in the furnishing of educational programs.” This rule is very clearly described in the Anchorage Municipal Code. This tax is collected by the hotel when you book a stay. Chapter 12-26 states that: “Room rental taxes at rate of 10% may also be paid by a resident of the city who occupies a room or rooms or the owner or custodian of a room and who is employed in the city for a minimum of 4 consecutive months. The tax may be paid upon leaving the city where the rental is effected.” The lodging tax is collected twice per quarter. It is not an excise tax. The tax is applied to the full rental amount of a room, including the amount paid by the resident. The tax is collected from the hotel before the money for the room is even spent. In other words, there is no credit or refund to you. There is no interest. They will bill you. If you are a low income individual, this is not a tax you want to pay. Alaska State Fair — Mini.org The Alaska State Fair is the premier event in the country. The fair serves the entire State of Alaska with its annual exposition featuring rides, games, entertainment, family fun and so much more.

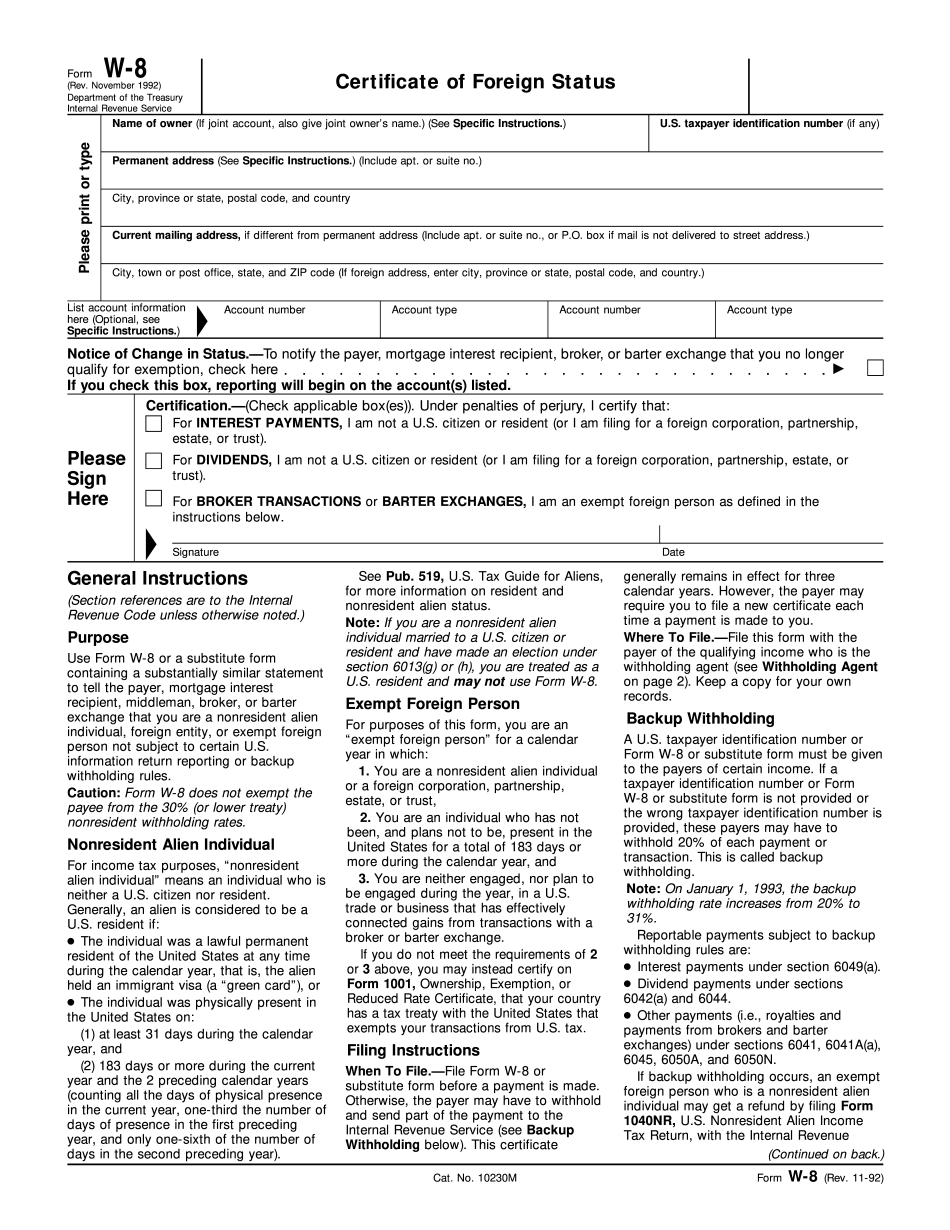

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-8 Anchorage Alaska, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-8 Anchorage Alaska?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-8 Anchorage Alaska aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-8 Anchorage Alaska from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.