Award-winning PDF software

Foreign tax identifying number W8ben india Form: What You Should Know

When the IRS requires an individual to file the W-8BEN, it is an IRS requirement, not a law, that it be filed. If done wrong, these documents will make the IRS believe the individual is living outside the country The Indian government must issue the individual a Tax Identification Number which is not issued by India and this is the actual basis for a US tax resident. The number is usually 4 digits — For the US, the 4 digits that must appear on Form W-4 are: 4.1- Digits assigned for tax purposes are a dependent child, father, mother, 4.2 — If you are a U. S. citizen, you can use one of the 1, 2, or 3-digit numbers above 4.3- If you are not a US citizen, the 4.3 code is: 3 Digits — The first digit must be your full name. 4.8 and above — Your country of birth. For most tax-compliant people, this will be their full name. However, the number is not unique and can be used in various countries. What is the TIN? Enter the TIN that is on your Indian Certificate of Naturalization. Some US states require the 3-digit number as proof of US residency. Some people use a combination of these numbers to get a TIN number from their passport. In the US, Indian citizens have to use the 4 digits above to figure it out. A US person who has a valid Tax Identification Number, which is a TIN is tax-free, as there is no tax charged. As long as you don't file a U.S. income tax return on foreign investments, you will not pay the foreign taxes. Some Indian companies have a policy of asking for the TIN as a condition for doing any deals there. If you are not a US citizen, you should avoid using this number to get the deal done. But, if you are going to get a U.S. deal, you can use this number. If you are not a citizen of India, but will be doing business in India and want to know the TIN number, you must register for an ITIN number and a TIN number. Once those procedures are completed, and you are legally a resident of India, you can get a TCR.

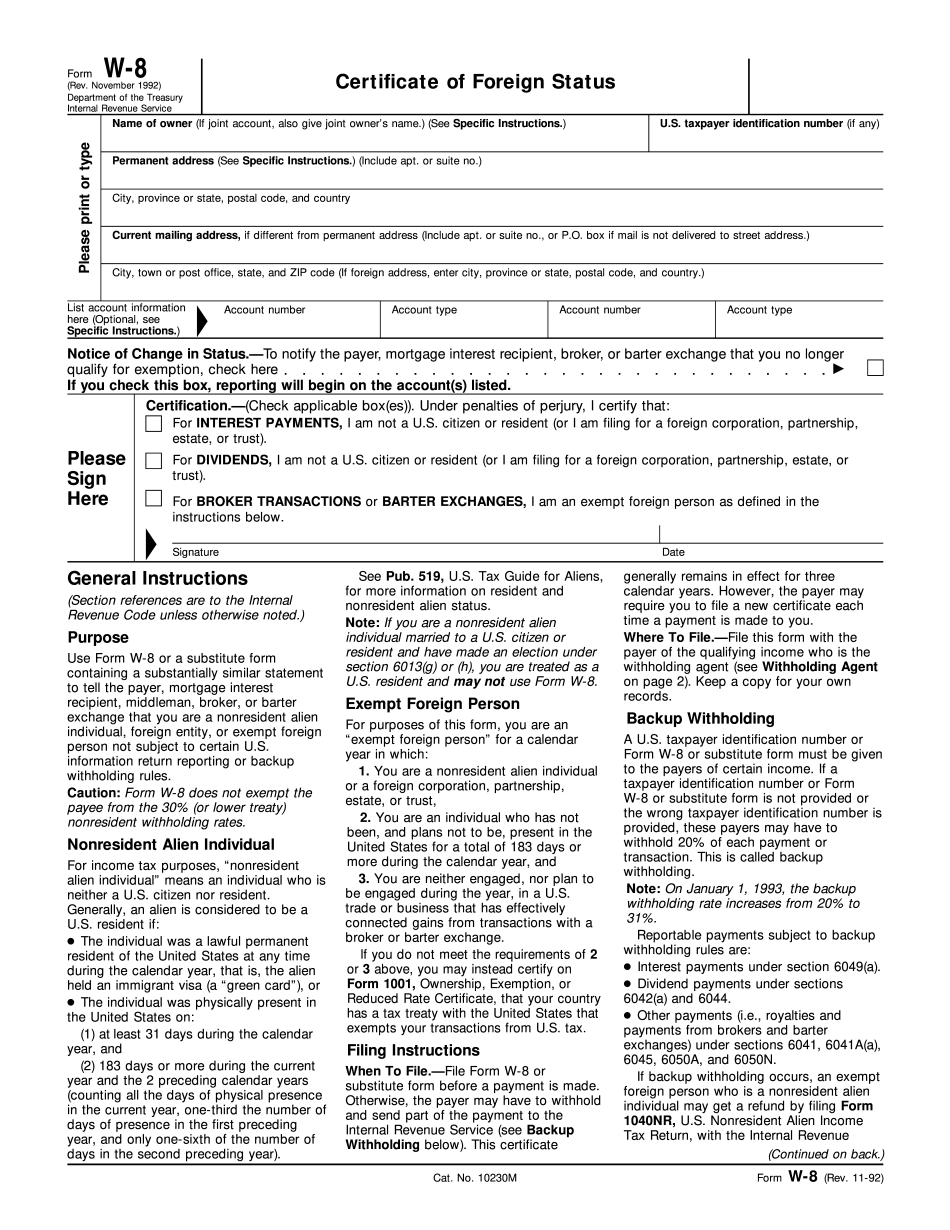

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-8, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-8 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-8 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-8 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.