Award-winning PDF software

W8-ben instructions Form: What You Should Know

The same rules that apply to the U.S. citizen resident with the same country of residence under U.S. tax law apply to a dual citizen resident of another country under another tax law (even if the resident does not have citizenship with the other country).4. Part II — U.S. Taxable Income:5. Indicate the amount of U.S. source income on Form W-8BEN you’ve included on your Form 1040, U.S. Individual Income Tax Return, and Form 1040NR, Nonresident Alien Income Tax Return. The amount of tax withheld and the amount of U.S. source income you include on Form W-8BEN does not count as an itemized deduction for U.S. income tax purposes. If you are not sure whether you will be taxed at a higher rate based on income from sources within the United States or with foreign income, contact a tax professional.6. Part III — Total Taxable Income: The total of your foreign source taxes withheld and the foreign source income paid or accrued does not include the withholding allowances shown on Form 1040, U.S. Individual Income Tax Return, and Form 1040NR, Nonresident Alien Income Tax Return. If you have foreign source income and withheld foreign taxes on Form W-8BEN, you may be subject to a U.S. tax withholding based on these payments. See Taxes withheld from foreign sources ‖, later, if you are a nonresident alien, and you have foreign source income withheld because you are not a U.S. citizen. 7. Part IV — Net Income Before Withholding: Indicate on line 11 whether any of your foreign source foreign income is exempt from income tax because it is an exempt U.S. source. The exemption is applied twice: first to any income included on line 6 above and then to any income not included for the reason indicated on line 11. If you are a United States citizen, use line 11 to exempt income earned in Puerto Rico or the U.S. Virgin Islands. If you are a noncitizen, and you have income from foreign sources in Puerto Rico or the U.S. Virgin Islands that is excluded from your exempt U.S. income because you have no U.S. source income, you may need to include the foreign source income on line 1A using Form 8829, Report of Income From Foreign Source. See the Instructions for Form 8829 for more information.

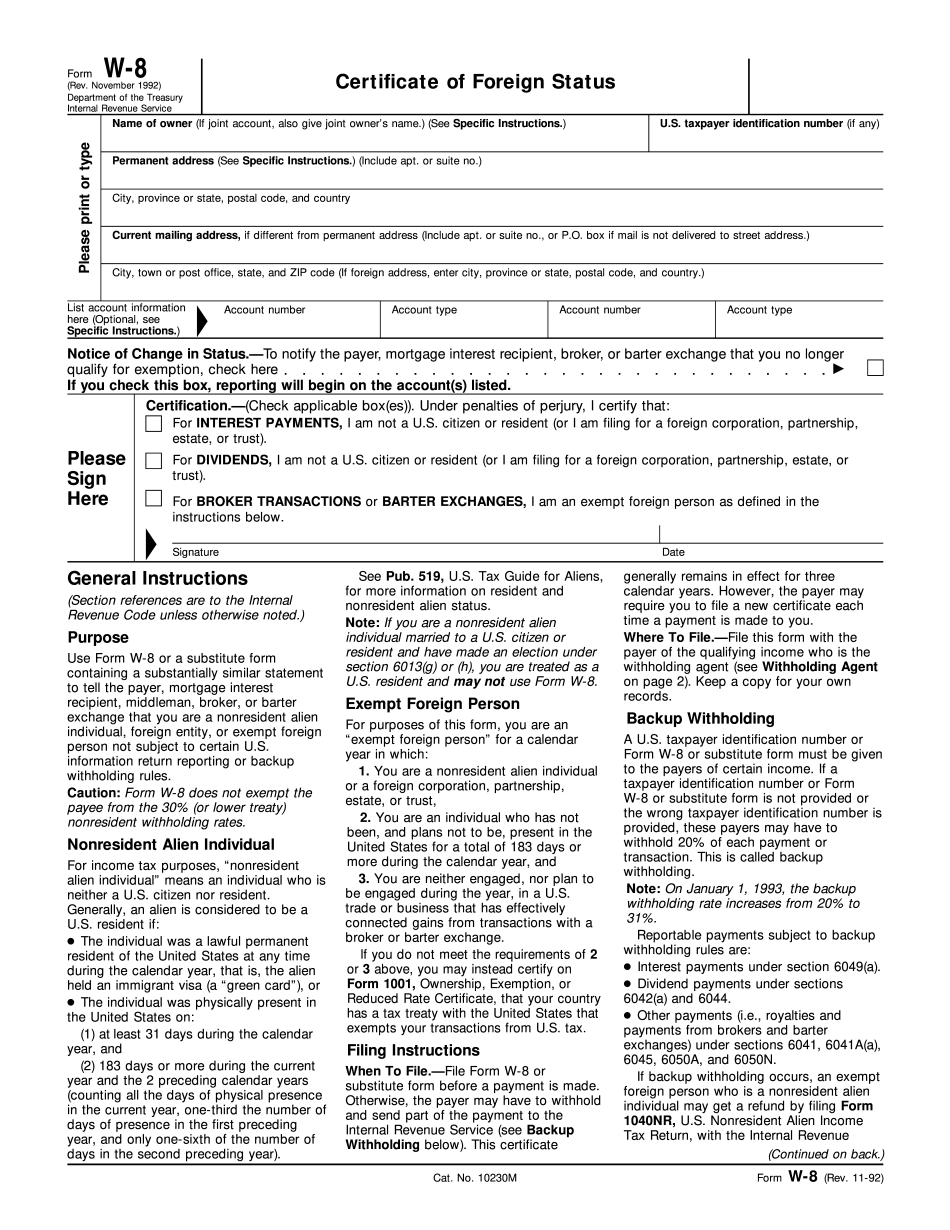

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-8, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-8 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-8 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-8 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.