Award-winning PDF software

What is W-8 Form: What You Should Know

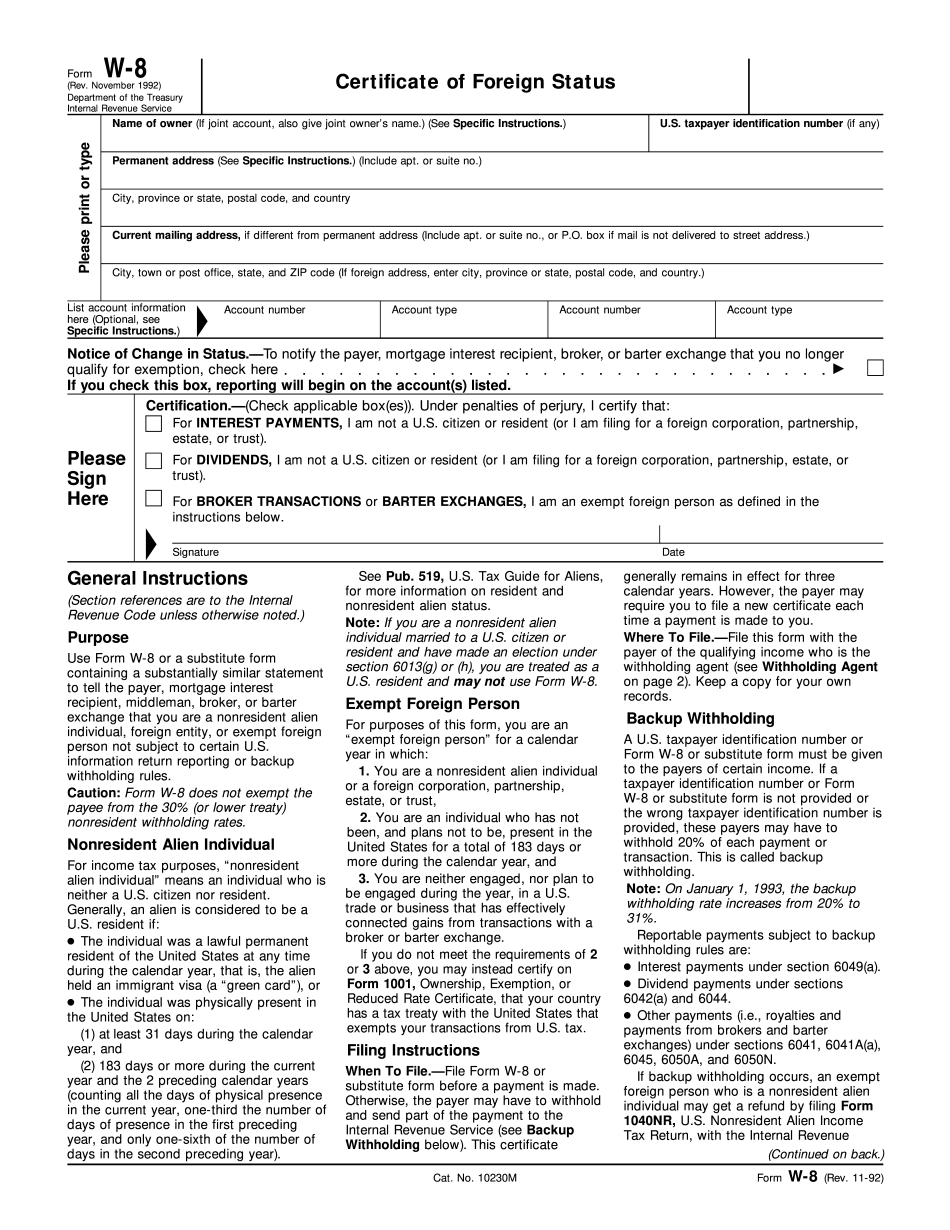

The Balance How to File a Tax Return and Form W-8 or the Balance | The Motley Fool IRS W-8 (Series) Forms — What you need to know | The Motley Fool Which Income Tax Form is Needed by an Employee? How To Use Forms W-8 If You Are Married or Living With a Filing With the IRS 1. Where do I file? If you must file your returns or claim exemptions electronically, you must complete Form W-8, the “Application for a U.S. Tax Refund”. This form is available from the U.S. Internal Revenue Service. You also should be familiar with the rules under IRS instructions for Form W-8, the “Form 843 Certificate of Foreign Status for the Foreign Earned Income Exclusion and the Foreign Corporation Income Tax Exclusion.” Also, for the income tax withholding requirement you need to review IRS instructions for IRS Form W2 (Certified Annual Financial Report) and IRS Forms W-2C (Certified Financial Statement) and W-3 (Statement of Transactions). If you are an employer with taxable wages, wages in excess of 600 (or 800 if your wages are in excess of 600) per month are subject to the W2C withholding and W2 reporting. The W-2C requires employers to withhold the federal insurance contributions tax (FICA) equal to 3.8% of the wages and reports the W2G withholding under a withholding code. The minimum wage for the 2025 calendar year is 10.30 an hour. For 2014, the minimum wage for the full calendar year is 9.50 an hour. Beginning in 2014, the minimum wage for the 2025 calendar year will be 10.10, and for 2013, the minimum wage for the entire calendar year will be 10.10. W-2C reporting for wages above and beyond the applicable 600 is required under IRS form 5055-B, “Employment Taxes with respect to Self Employment Income.” 2. What are forms I need? You must complete either: Forms 1040 and 1040A, which are also called “returns”; Forms 1040A-EZ and 1040ES, which are called “statements of accounts”; or Forms 1040, 1040A, 1040EZ, 1040ES.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-8, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-8 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-8 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-8 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.